Shortly after General Electric spun off its HealthCare division, the newly released company started buying AI technology. To share some strategic insights, Digital Science’s IFI CLAIMS Patent Services has taken a look at the target companies’ patents to see what capabilities they’re bringing into the medical technology company.

The phrase ‘patently obvious’ is used in many contexts, from political exchanges to newspaper op-ed columns. Curiously, it is rarely used in the realm of actual patents, but in the case of General Electric’s (GE) HealthCare division, its use seems entirely appropriate.

In early 2023, GE made the decision to spin off GE HealthCare, and immediately following the move the new entity started its M&A strategy by acquiring two companies of its own – Caption Health and IMACTIS. At this early stage, is it possible to infer whether these were sound investments? Six months later, there is still a way to go before full year financial results are posted along with other financial data. However, Digital Science company IFI CLAIMS Patent Services – a global patent database provider for application developers, data scientists, and product managers – can gain insights by looking into the patents the newly enlarged GE HealthCare now holds.

Patents = Strategic Insights

It should be ‘patently obvious’, but checking companies’ patents can be a part of any due diligence process before an investment decision is made. Not only does this help understand risk and technology overlaps, it can also be used to determine where R&D efforts are currently focused in the target acquisition, and in turn set the strategy for the newly merged entity. Analyzing a company’s patent holdings in the midst of M&A dealings provides insights, such as:

- Strategic direction of companies (i.e., such as the extent to which they are making strides in AI)

- Unique takes on M&A transactions as it is possible to determine – based on companies’ technologies – if core competencies overlap or not with the acquiring company

- Ascertaining if a company’s core competencies are enhanced or not by the acquisitions it’s made

IFI’s latest acquisition report takes a look at GE HealthCare’s acquisitions of IMACTIS and Caption Health’s patented technologies to determine the innovative direction of the company.

‘A good fit’

So what insights can be gleaned from patent data about GE HealthCare and its nascent M&A strategy? According to the report, the acquisition of Caption Health and IMACTIS were a ‘good fit’ for GE HealthCare. Both the acquisitions point towards GE HealthCare’s continued growth in terms of both AI and the application of AI to its existing core technologies. Specifically:

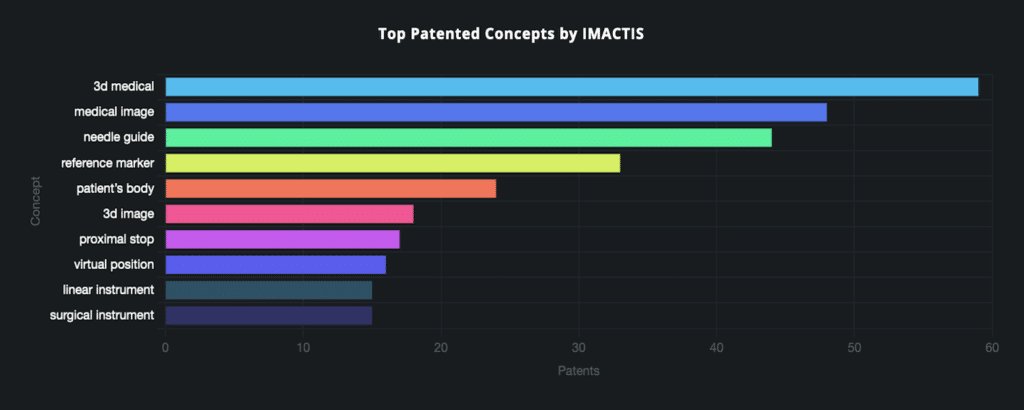

- IMACTIS is a tech healthcare company that offers, among other things, the provision of 3D virtual imaging to surgical navigation

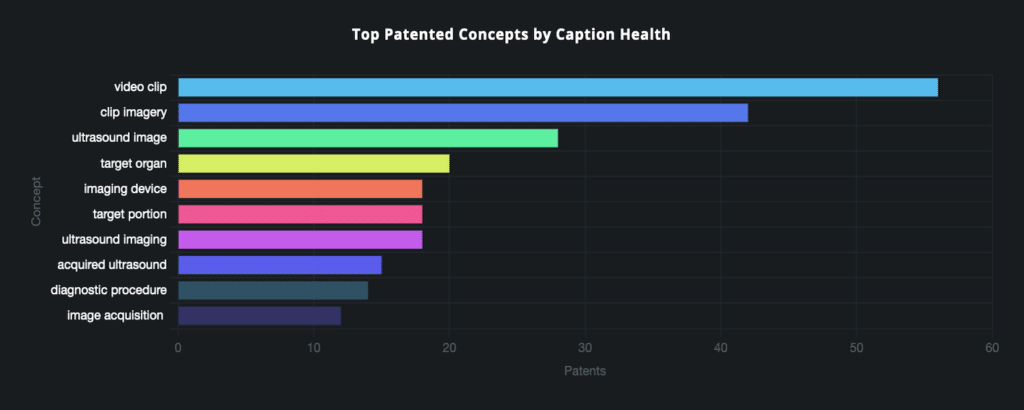

- Caption Health focuses on providing AI capabilities and image data generation to ultrasound technologies

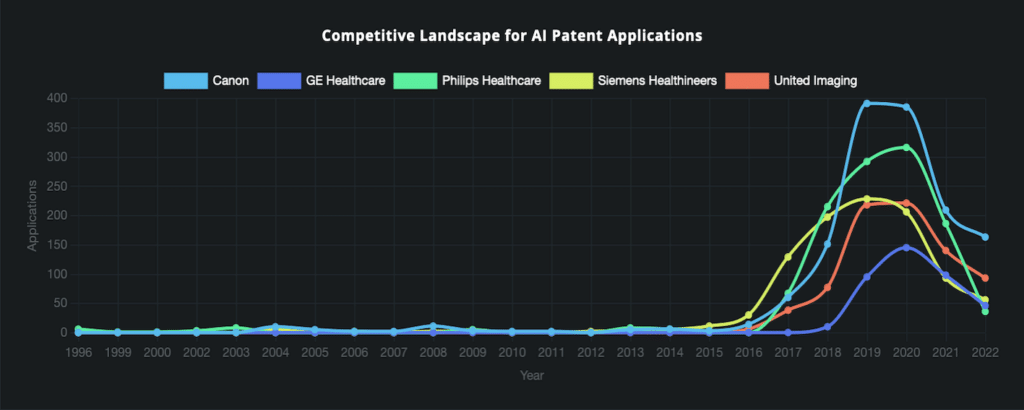

You can see from the chart below that GE HealthCare competes with a number of major companies in establishing AI-related patents, which surged in 2019-2020 before dipping in 2021. As such, the acquisitions in the early part of 2023 of companies that are focused on technology and AI in particular seem to be a good strategic move, especially given the furore around AI technology since late 2022.

What the data says

The report concludes that both Caption Health and IMACTIS make sense for GE HealthCare for several reasons. In the current competitive climate, Caption Health adds necessary AI capabilities while IMACTIS adds new dimensions to the suite of patents it has with 3D virtual images. So overall, it’s a gold star for GE HealthCare when it comes to enhancing its patent – and future commercial – strategy. Isn’t that obvious?

Three key takeaways

1. Digital Science’s IFI CLAIMS Patent Services – a global patent database provider for application developers, data scientists, and product managers – can help customers gain insights by looking into the patents held by firms, such as newly enlarged GE HealthCare.

2. IFI’s latest acquisition report takes a look at GE HealthCare’s acquisitions of IMACTIS and Caption Health’s patented technologies to determine the innovative direction of the company – the report concludes that both Caption Health and IMACTIS make sense for GE HealthCare for a number of reasons.

3. Checking companies’ patents should be a part of any due diligence process before any corporate investment decision is made, especially in pharmaceuticals sector.

About the Author

Simon Linacre, Head of Content, Brand & Press | Digital Science

Simon has 20 years’ experience in scholarly communications. He has lectured and published on the topics of bibliometrics, publication ethics and research impact, and has recently authored a book on predatory publishing. Simon is an ALPSP tutor and has also served as a COPE Trustee.

The post AI: To Buy or Not to Buy appeared first on Digital Science.

from Digital Science https://ift.tt/HtGnMQ2

No comments:

Post a Comment